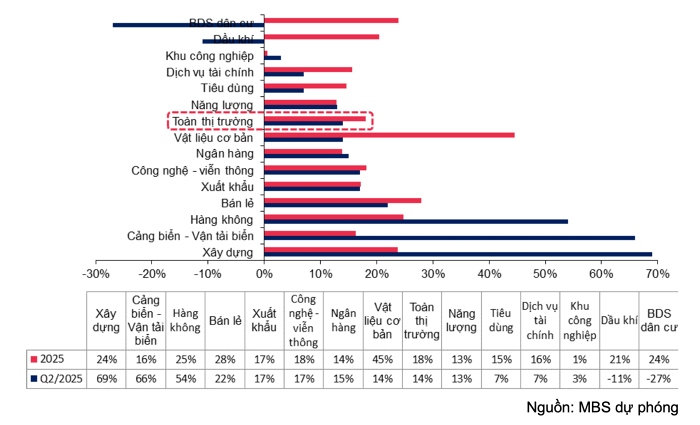

In a recent report, MBS Research said that the banking, port and basic materials sectors continue to be the growth drivers, while some sectors such as real estate and oil and gas face difficulties. According to MBS Research's forecast, the profit of the entire Vietnamese market in the second quarter of 2025 could record a growth rate of 14% compared to the same period last year.

However, global political and trade uncertainties continue to put significant pressure on some sectors. In this context, sectors with stability and significant potential for improvement such as banking, ports and basic materials (steel) will play a key role in maintaining growth.

In the second quarter of 2025, banking industry profits are forecast to increase by 15% year-on-year to VND25,000 billion, thanks to strong credit growth and stable net interest margin (NIM). As of June 16, credit in the entire banking system grew by 6.99% year-on-year, far exceeding the 3.75% growth rate in the same period in 2024. Joint stock commercial banks (JSCs) such as VPB, EIB, and CTG are expected to maintain positive growth momentum thanks to the borrowing needs of businesses, especially in the construction and export sectors.

Specifically, VPB forecasts that its profit in the second quarter of 2025 will reach VND5,046 billion, up 39% year-on-year. EIB and CTG will also record impressive growth with expected profits of VND859 billion and VND7,184 billion, up 34% and 33% year-on-year.

In terms of policy, Decree 69/2025/ND-CP allows foreign room to be increased to 49% at banks receiving compulsory transfers such as VPB, MBB, HDB, creating room for capital increase but not urgent because these banks still have high CAR. The draft to legalize Resolution 42 will help the industry handle debt more effectively, especially beneficial for banks with high provisioning costs such as CTG, VPB and small-scale banks such as OCB, MSB, VIB.

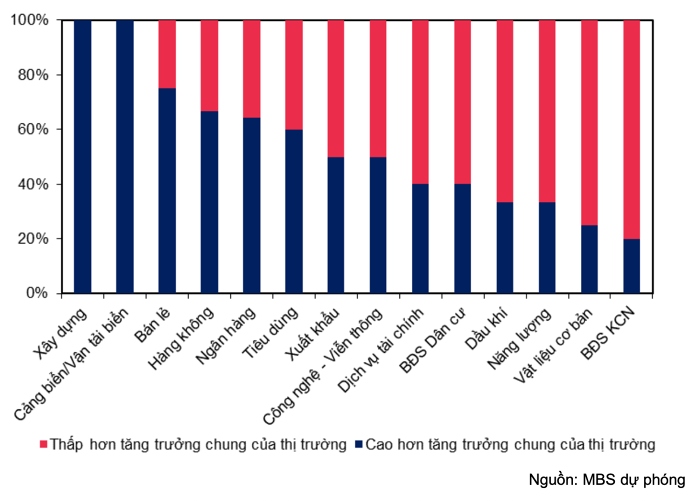

Construction, seaports & shipping, retail, aviation, and banking are industries with a large proportion of businesses with profit growth in the second quarter of 2025 higher than the general market.

The port and shipping industry continues to be one of the bright spots in the second quarter of 2025. Revenue from shipping is expected to increase sharply thanks to the recovery of export contracts, especially with major countries such as the US and Europe.

Vietnam's total import-export turnover in the first 5 months of 2025 increased by 15.7% over the same period, of which exports to the US increased by 28.6%. This creates great opportunities for seaport enterprises in the Ba Ria - Vung Tau region, where the proportion of exports to the US accounts for 50-55% of the total turnover of this region.

GMD and HAH are two enterprises in the seaport industry that are expected to continue to maintain strong growth momentum. GMD forecasts that its second quarter 2025 profit will increase by 33% year-on-year, reaching about VND439 billion, thanks to increased output and port revenue. Meanwhile, HAH forecasts that its profit will reach VND248 billion, up 122% year-on-year in 2024.

In addition, the second quarter of 2025 also recorded a breakthrough in a number of other prominent industries. The construction industry is forecast to have a profit growth rate of up to 69% compared to the same period last year, driven by strong public investment disbursement and the recovery of the industrial and commercial real estate market.

The aviation industry also recovered strongly with a forecast profit growth of 54% over the same period. The increase in international and domestic passengers thanks to the open tourism policy, stable fuel prices and the expansion of new routes have helped airlines such as Vietnam Airlines, Vietjet Air, and Bamboo Airways significantly improve their business results.

Aviation service and airport logistics businesses also benefit from this trend, contributing to the overall growth of the industry.

The steel market in the second quarter of 2025 continued to record breakthrough growth. Steel consumption in this quarter is forecast to increase by 22% over the same period last year, reaching about 7.1 million tons. Construction steel is expected to consume 3.1 million tons, up 14% over the same period, mainly thanks to increased public investment and the recovery of the real estate industry.

Hoa Phat (HPG), one of the largest steel companies in Vietnam, forecasts a profit of VND3,900 billion in the second quarter of 2025, up 19% year-on-year. Thanks to increased output and improved gross profit margin, Hoa Phat continues to maintain its leading position in the Vietnamese steel industry.

Forecast of profit growth in Q2/2025 and the whole year 2025 for all industry groups.

While sectors such as banking and ports are expected to recover, the residential real estate sector will still face many challenges in the second quarter of 2025. The profits of residential real estate businesses are forecast to decrease by 27% compared to the same period in 2024, mainly due to the fact that product handovers have not been as vibrant as expected.

VHM (Vingroup), một trong những ông lớn trong ngành bất động sản, dự báo lợi nhuận quý II/2025 sẽ giảm 27% so với cùng kỳ năm ngoái, đạt 7.850 tỷ đồng. Tuy nhiên, VHM vẫn duy trì triển vọng tích cực nhờ các dự án trọng điểm như Wonder City và các khu vực đang phát triển mạnh tại khu vực phía Nam.

Ngành bán lẻ tiêu dùng cũng chứng kiến sự phục hồi tích cực trong quý 2 năm 2025. Tổng doanh thu bán lẻ và dịch vụ hàng hóa ước tăng 7,4% so với cùng kỳ năm ngoái. Các chuỗi bán lẻ hiện đại như MWG và FRT ghi nhận mức tăng trưởng ổn định nhờ mở rộng quy mô và cải thiện doanh thu tại các cửa hàng.

Cụ thể, MWG (Thế giới di động) dự báo lợi nhuận quý 2/2025 tăng trưởng 21% so với cùng kỳ, đạt 1.460 tỷ đồng, nhờ sự phục hồi của các chuỗi cửa hàng như Thế giới di động, Điện máy Xanh. Tuy nhiên, FRT (FPT Retail) sẽ đạt tốc độ tăng trưởng đột phá hơn, với lợi nhuận dự báo tăng 292% so với cùng kỳ năm 2024, đạt 105 tỷ đồng.

Nhìn chung, sự phục hồi của nền kinh tế Việt Nam trong quý II năm 2025, nhờ các chính sách hỗ trợ và cải cách trong các lĩnh vực chủ chốt, báo hiệu tốt cho phần còn lại của năm. Điều này cho thấy nền kinh tế linh hoạt, có thể thích ứng nhanh với những biến động toàn cầu.

Tuy nhiên, doanh nghiệp cần duy trì chiến lược linh hoạt để thích ứng với những thách thức từ các yếu tố toàn cầu như xung đột thương mại, biến động chính trị và sự phục hồi của các nền kinh tế lớn. Mặc dù bất động sản và dầu khí đang gặp khó khăn, triển vọng phục hồi vẫn có thể đến từ các dự án cơ sở hạ tầng và giá dầu cao. Với các yếu tố tích cực từ các ngành chiến lược, nền kinh tế Việt Nam có thể tiếp tục duy trì đà tăng trưởng ổn định trong nửa cuối năm 2025.