According to an analysis report by Xeneta - a leading global platform for analyzing and comparing ocean and air freight rates, 15 days ago, on May 11, businesses were in a state of "hanging" over tariffs amid a sharp decline in demand for container shipping on the main trade route from China to the US.

The fact that news of a potential spike in freight rates has now begun to emerge – following the announcement of a temporary reduction in import tariffs between the US and China – shows how quickly things can change and why it is increasingly difficult for shippers to control their supply chains amid the current uncertainty.

“There will certainly be more volatility, but shippers can leverage data to understand where freight rates are headed in the coming weeks and implement agile strategies to mitigate supply chain risks,” Xeneta said.

Impact of the “90-day opportunity”

The US announcement to reduce import tax on goods from China from 145% to 30% within 90 days is like a starting shot for businesses to take advantage of exporting as much as possible in this short period of time.

Shipping lines are not missing the opportunity to impose surcharges as capacity tightens – putting shippers in a difficult position.

Everyone is well aware of the “90-day window” and the financial consequences of missing the deadline. Even if freight rates spike to the levels seen during the disruption caused by the conflict in the Red Sea last year, that would be small compared to the financial hit if tariffs were to return to 145%.

Shippers know this all too well – and perhaps more importantly, carriers know it too – as announcements of a general rate surcharge (GRI) increase have already been made that will push total freight rates to $7,000 per 40-foot container (FEU) to the US East Coast starting June 1.

Xeneta said that while these increases may not be sustainable, they show the carriers' intentions.

How much will the fares increase?

Xeneta found that shippers are willing to pay more if it helps their goods reach the US within the “golden 90 days” period.

Immediately after the announcement of “Tariff Release Day”, some shippers switched to air freight to ship their goods in time – although air freight rates were much higher, they were still “reasonable” compared to the risk of being reimposed tariffs.

The question is: how high can carriers charge in the coming weeks?

The answer lies not in rationality or in the balance between supply and demand. Freight rates will rise to the level that shippers are willing to pay to ensure that their goods are delivered on time.

While some businesses were willing to absorb air freight costs to protect their supply chains last month, they are now willing to pay sky-high rates for ocean freight.

Fare data analysis

According to Xeneta, the behavior of shippers can be reflected in freight rate fluctuations.

For example, on the China-US West Coast route, average freight rates have increased by 8% since May 14, from $2,600/FEU to $2,805/FEU.

However, Xeneta notes that this average is likely to increase further. With the announcement of the US-China tariff reduction coming so suddenly, the immediate priority for shippers is to “get their goods out quickly” – which means that the average price will continue to increase as more shippers renegotiate higher rates with carriers.

More notably, data from the Xeneta platform shows that fares in the highest-paying group in the market, which accounts for about 25% of users willing to pay high prices, have increased by 18% over the same period – from $2,620/FEU to $3,100/FEU.

This segment is almost certainly the shippers who are most responsive to tariff reduction news and are willing to pay higher prices to get their goods shipped immediately.

However, to build a sustainable supply chain, businesses do not necessarily have to sacrifice financial efficiency – as long as they understand the factors that are affecting freight rates and know which price segments they should target.

Long term impact

Uncertainty and concern can push freight rates up sharply, even in the absence of obvious factors such as ship shortages or port congestion.

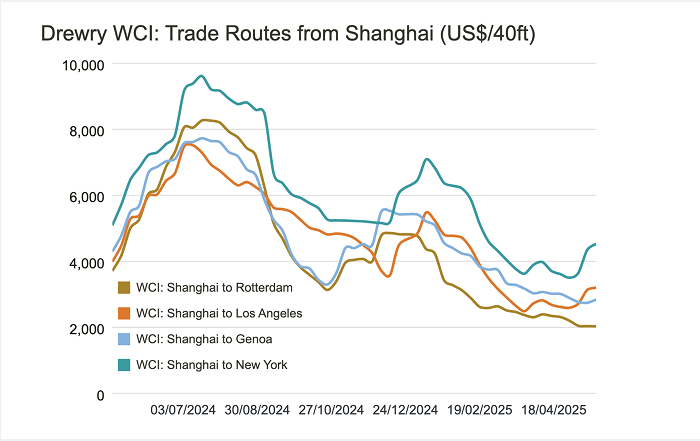

The market has seen “skyrocketing” freight rates during the Covid-19 pandemic, and again during the conflict in the Red Sea. However, unlike previous shocks, this surge – triggered by the decision to lower tariffs – will be short-lived.

After the slump in consumer demand at the beginning of the pandemic, the market witnessed a strong "product release". This time, the increase in demand is simply for businesses to increase inventory reserves, in case the tax returns. Although the tax rate is not certain to return to 145%, who dares to bet?

There is also no big consumption boom forecast for 2025. Even with the reduction in taxes, they will still be higher than before – which will continue to hold back demand.

Once they have stocked up, shippers will stop importing ahead of schedule. Demand will drop, and shipping lines will struggle to fill their holds again.

This means that the third-quarter peak season will arrive earlier in 2025, but rates will not remain high for long – instead resuming the downward trend seen in the first quarter.

While carriers may cut capacity again – as they did during the 145% tariff period – it will not be enough to prevent prices from falling to unprecedented lows by the fourth quarter of 2023.

Time to market is key

Understanding market fluctuations is extremely important for businesses that have just signed long-term transportation contracts effective from May. If they want to push goods early and exceed their minimum quantity commitment (MQC), they will be pushed into the hot spot market.

Spot market developments in the coming weeks will also have a major impact on the timing of renegotiating long-term contracts for those businesses that are still hesitant.

Obviously, negotiating freight rates during the current period of rising prices is very different from when the market cools down, goods are imported and shipping lines add capacity.

Scientific Workshop ' Private economy is the most important driving force of the economy ' chaired by the Vietnam Association of Private Entrepreneurs, organized by Vietnam Entrepreneurs Electronic Magazine. The scientific workshop will take place at 8:00 a.m. on May 26, 2025, at Thang Loi Hotel, 200 Yen Phu, Hanoi.

The workshop was attended and discussed by representatives of a number of Party agencies, ministries, branches, leading economic experts, representatives of associations, banks, private entrepreneurs, etc.

In addition to individual presentations from representatives of Party agencies, experts and association representatives, the workshop also focused on discussing key issues such as opportunities, potentials and challenges of the private economy in its mission as the most important driving force of the economy, as well as the full and scientific institutionalization of Resolution 68/NQ-TW into practice in the era of national development.