Shareholders of Vinaship Shipping (VNA) are about to receive more than 20 billion VND in dividends in 2024

Posted on: 25/09/2025

Plan to spend nearly 20.4 billion VND to pay dividends

Vinaship Shipping Joint Stock Company (stock code: VNA) has just issued a document announcing the payment of 2024 dividends to shareholders.

Accordingly, Vinaship will pay dividends to shareholders in cash at a rate of 6%, meaning that shareholders owning 01 share will receive 600 VND. It is expected that VNA shareholders will receive dividends on October 20, 2025.

With nearly 34 million VNA shares in circulation on the market, it is estimated that Vinaship will have to spend about 20.4 billion VND for this dividend payment to shareholders.

As of June 30, 2025, Vietnam National Shipping Lines - JSC (VIMC) owns 51% of Vinaship's charter capital, equivalent to owning more than 17.3 million VNA shares, estimated to collect more than VND 10.4 billion in dividends.

In addition, Vietnam Container Joint Stock Company (Viconship, stock code: VSC ) is owning more than 13.6 million VNA shares, estimated to receive nearly 8.2 billion VND in dividends from Vinaship this time.

After-tax profit for the first half of 2025 decreased sharply

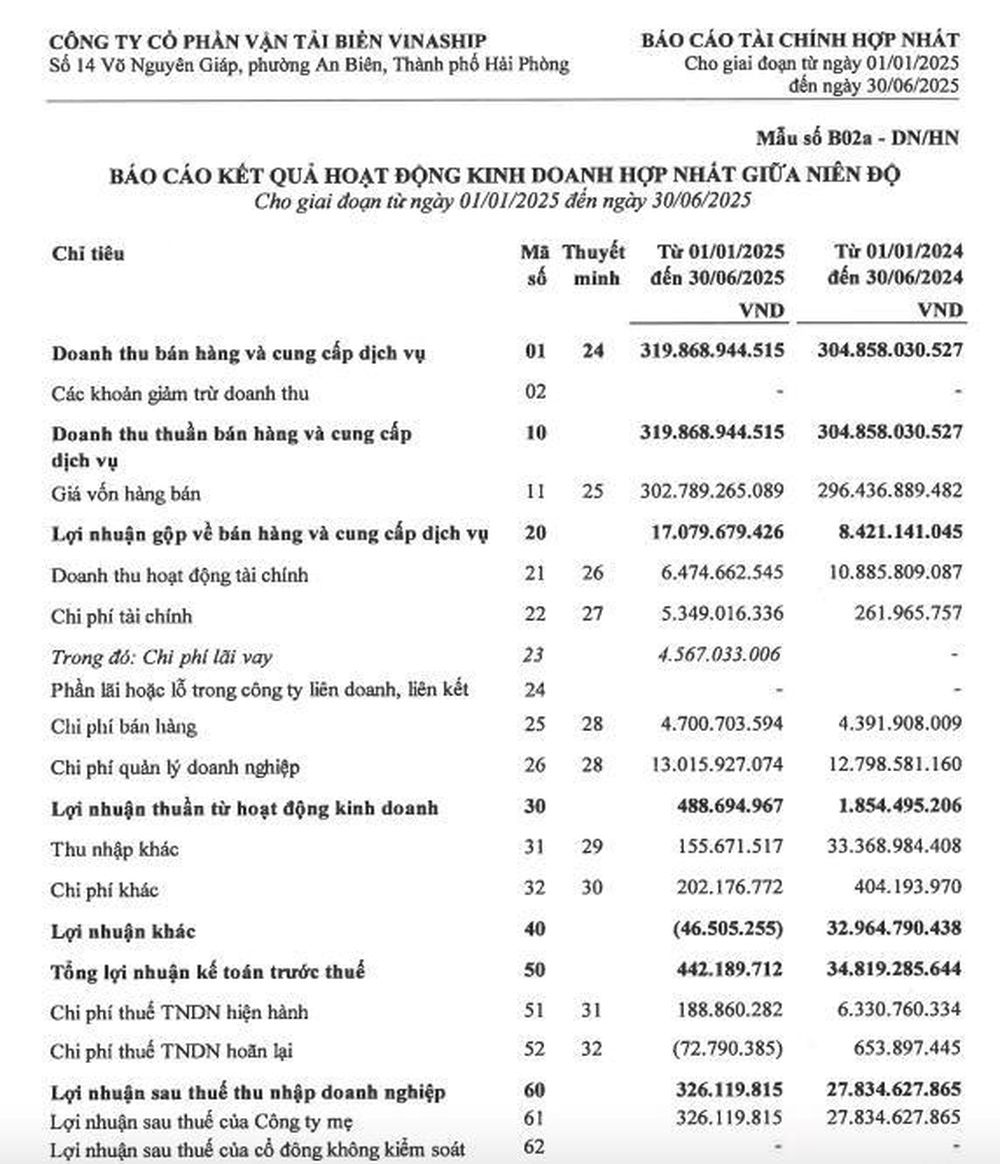

Regarding the business picture , according to the audited consolidated financial report for the first 6 months of 2025, Vinaship brought in net revenue of nearly 319.9 billion VND, an increase of 4.9% compared to the first 6 months of 2024.

After deducting taxes and fees, the company reported a net profit of just over VND326.1 million, down 98.8% compared to the net profit of over VND27.8 billion in the same period last year.

According to Vinaship’s explanation, the international dry cargo shipping market in the first 6 months of 2025 experienced many fluctuations. At the same time, for the shipping market that Vinaship fleet participates in, the group of cement imported from Vietnam to the Philippines tends to decrease in both output and freight rates.

Due to the Philippines imposing safeguard tariffs, Vietnamese producers prioritize the high-priced domestic market and clinker exports are more efficient.

Regarding rice, although the Philippines still maintains regular import activities from Vietnam and Thailand, the Indonesian market has not shown any signs of resuming operations.

Maritime operations in the first 6 months of 2025 encountered unfavorable market factors, unstable cargo sources, increased time charter rates, as well as ship exploitation activities facing some unforeseen risks, incurring many costs, causing the production and business efficiency of Vinaship's fleet to decrease compared to the same period last year.

As of June 30, 2025, Vinaship's total assets decreased by 4.4% compared to the beginning of the year, down to nearly VND 773.4 billion. Of which, fixed assets accounted for 51% of total assets, at more than VND 394.8 billion; inventories were nearly VND 37.2 billion.

On the balance sheet, total liabilities are at over VND206 billion, down 11.1% compared to the beginning of the year. Of which, short-term and long-term loans and financial leases reached over VND135 billion, accounting for 66% of total debt.