1. Air cooler import policy

Air coolers are classified as household electrical goods. The procedures for importing air coolers are stipulated in the following legal documents.

-

VAT Law 13/2008/QH12 dated June 3, 2008;

-

Decision 04/2017/QD-TTg dated March 9, 2017;

-

Circular 38/2015/TT-BTC dated March 25, 2015 amending and supplementing 39/2018/TT-BTC dated April 20, 2018;

-

Decision 3810/QD-BKHCN dated December 18, 2019;

-

Decree 69/2018/ND-CP dated May 15, 2018;

-

Circular No. 09/2019/TT-BKHCN dated September 30, 2019;

-

Official Letter No. 10442/TCHQ-TXNK dated November 4, 2016;

-

Decree No. 43/2017/ND-CP dated April 14, 2017;

-

Decree 128/2020/ND-CP dated October 19, 2020;

According to the above documents, air coolers are not on the list of prohibited imports. However, when carrying out procedures for importing air coolers, the following points must be noted:

-

Used air coolers are prohibited from import;

-

When importing air coolers, the goods must be labeled according to 43/2017/ND-CP;

-

Correctly identify the HS code to determine the correct tax and avoid fines.

Above are the policies regulating the import of air coolers. If you do not fully understand the above policies. Please contact the hotline or hotmail for advice.

2. Determine the HS code of the air cooler

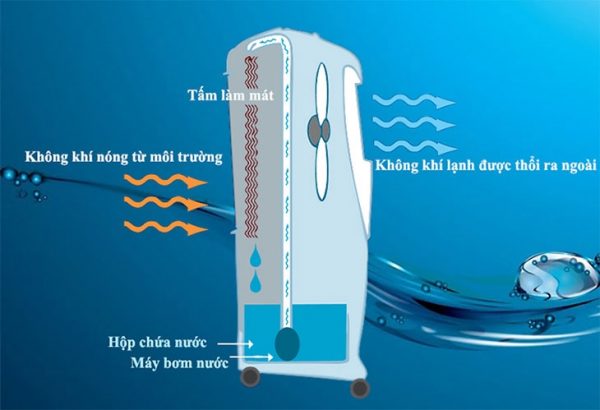

Determining the HS code is the most important step when carrying out import procedures for any type of goods. Determining the HS code will determine import tax, VAT and import policy. To correctly determine the HS code of the air cooler, you need to understand the characteristics of the goods: Material, composition and characteristics of the product.

2.1. HS code of the air cooler

The HS code (Harmonized System) is a series of codes used for all goods worldwide. Between different countries in the world, only the tail number is different. Therefore, the first 6 numbers of the HS code worldwide for an item are the same. Below, Just In Time would like to share with you the HS code table of air coolers.

|

HS Code |

Description |

|

84796000 |

HS code for air cooler |

According to the import and export tax schedule, the air cooler has the HS code 84796000. The import tax is 0% and the VAT is 8%.

2.2. Risks of applying the wrong HS code

Determining the correct HS code is very important when carrying out procedures for importing air coolers. Determining the wrong HS code will bring certain risks to you such as:

-

Delay in customs procedures: Declaring the wrong HS code can lead to delays in customs procedures, because it takes time to check and verify the correct information about the type of goods.

-

Penalty for declaring the wrong HS code according to Decree 128/2020/ND-CP;

-

Delayed delivery: If the goods are found to have an incorrect HS code, the customs authority may request correction or clarification of the information. This can lead to delays in the delivery process and affect the production and business cycle of the enterprise.

-

In case of import tax, you will face a minimum fine of 2,000,000 VND and a maximum fine of 3 times the tax amount.

To determine the exact HS code for a specific type of air cooler. Please contact the hotline or hotmail for advice.

3. Import tax on air coolers

Determining import tax is an important task when carrying out procedures for importing air coolers. The import tax of goods depends on the HS code of that item. Each HS code has a specific tax rate. Here, Just In Time would like to introduce how to calculate import tax and notes when determining tax for air coolers.

3.1. How to calculate import tax on air coolers

Import tax on air coolers is calculated according to the same formula as other items. Import tax on this item has two types: import tax and import VAT.

Import tax determined by HS code Import tax is calculated according to the formula:

Import tax = CIF value x % tax rate

Import VAT is determined according to the formula:

Value added tax = (CIF value + Import tax) x % VAT.

CIF value is determined by the factory value of the goods plus all costs to bring the goods to the first border gate of the importing country. Import tax is the cost included in the cost of goods sold of the order. Therefore, you must check the correct HS code to apply the best import tax code.

3.2. Notes when determining import tax on air coolers

When determining import tax on air coolers, you need to note the following points:

-

For countries that have signed trade agreements with Vietnam such as: Europe, India, Australia, Chile, China, Korea, Japan, ASEAN countries. It is important to note that the special preferential tax rate is usually 0%.

-

To enjoy the preferential tax rate, a certificate of origin is required;

-

The taxable value is the CIF value. For orders purchased under other conditions. When calculating import tax, the value must be converted to the CIF value to calculate import tax.

-

Import tax will also be subject to VAT.

These are notes when calculating import tax for air coolers. If you do not understand how to calculate tax and the above notes. Please contact the hotline or hotmail for advice.

4. Import procedure dossier

The dossier for import procedures for air coolers in particular, and other items in general. Stipulated in Circular 38/2015/TT-BTC dated March 25, 2015; amended and supplemented by 39/2018/TT-BTC dated April 20, 2018.

-

Customs declaration;

-

Bill of lading;

-

Commercial invoice;

-

Sale contract;

-

Packing list;

-

Certificate of origin (℅) if any;

-

Catalogs;

Above are all the documents in the file for importing air coolers. The following documents are the most important: Customs declaration, bill of lading, commercial invoice. Other documents will be provided upon request from the customs.

Certificate of origin is not a mandatory document. However, this is a very important document for importers to enjoy preferential import tax rates. Therefore, importers should negotiate and request the seller to provide a certificate of origin.

If you do not understand the file for importing air coolers. Please contact the hotline or hotmail for advice.

5. Procedures for importing air coolers

The procedure for importing air coolers is the same as for many other items. It is very specifically regulated in Circular 38/2015/TT-BTC dated March 25, 2015, amended and supplemented by Circular 39/2018/TT-BTC dated April 20, 2018. We summarize the steps briefly so that you can visualize the whole picture.

Step 1. Declare customs declaration

After having complete import and export documents: Contract, commercial invoice, packing list, bill of lading, certificate of origin, notice of arrival and determining the HS code of air coolers. Then you can enter the declaration information into the customs system via the software.

Declaring customs declarations on customs software. Requires the importer to have knowledge about entering data into the software. You should not arbitrarily declare customs declarations when you do not fully understand this work. Arbitrarily declaring can make mistakes that cannot be corrected on the customs declaration. At that time, it will cost a lot of money and time to fix.

Within 30 days from the date the goods arrive at the port, the customs declarant must make a customs declaration. If this deadline is exceeded, the importer will face a penalty fee from the customs.

This is the most important step in the process of importing air coolers. All declaration contents will be pushed to the customs system. If there are errors affecting the tax or origin of the goods. The importer may face penalties according to customs law. Therefore, it is necessary to pay attention to the information entered on the declaration such as HS code, tax rate, product name, origin.

Step 2. Open the customs declaration

After completing the customs declaration, the customs system will return the declaration flow results. If there is a declaration flow, print the declaration and bring the import documents to the customs office to open the declaration. Depending on the green, yellow, and red lanes, the steps to open the declaration are performed.

The declaration must be opened as soon as possible, no later than 15 days from the date of declaration. The declarant must bring the documents to the Customs Branch to open the customs declaration. After 15 days, the declaration will be canceled and you will face a penalty fee from the customs.

Note: After having the official declaration, you need to contact the customs branch to proceed with the procedures for importing air coolers.

Step 3. Clearing the goods

After checking the documents, if there are no questions, the customs officer will accept the declaration. You can now pay import tax on the customs declaration to clear the goods.

In some cases, the declaration will be released to bring the goods to the warehouse for storage first. After completing the documents, the customs will proceed to clear the customs declaration. When the declaration has not been cleared, it is necessary to carry out the procedures for the declaration to be cleared. If it is overdue, you will face a penalty fee and it will take a lot of time.

Step 4. Bring the goods back for storage and use

For the customs declaration, proceed with the declaration liquidation step and carry out the necessary procedures to bring the goods back to the warehouse.

The above is the procedure for the steps to import air coolers. If you do not understand the steps, please contact us via hotline or hotmail for advice.

6. Notes when importing air coolers

In the process of importing air coolers for customers. Just In Time has drawn the following experiences, and would like to share them with you for reference. When carrying out procedures for importing air coolers, you need to note the following:

-

Import tax is an obligation to be fulfilled with the state;

-

VAT for air coolers is 8%;

-

Find a reputable supplier, choose a suitable payment method;

-

When importing air coolers, the goods must be labeled according to 43/2017/ND-CP;

-

Identify the correct HS code to determine the correct tax and avoid fines;

-

Used air coolers are on the list of prohibited import goods;

If you have difficulty with customs procedures, you can choose Just In Time as your companion.

Just In Time's staff is always enthusiastic to support you to handle your work quickly and professionally.

JUST IN TIME JOINT STOCK COMPANY

Address: No. 5, Dong Da, Ward 2, Tan Binh, Ho Chi Minh City.

Hotline: +84 83 9910066

Email: info@justintimevn.com

Facebook: https://www.facebook.com/justintimevn