RELATED NEWS

-

Prime Minister gives urgent instructions on a series of railway projects

While Vietnam's logistics industry is shifting strongly towards modernization and supply chain integration, railway transport, which is a strategic transport axis, is gradually losing its inherent position, with the proportion of freight transport only fluctuating around 0.3% - 0.8% of the entire industry.

The question now is: how to restructure the railway industry into an important link in the national logistics network, serving the goal of reducing transportation costs, reducing emissions and improving business competitiveness?

Knots on the railway system

Despite being identified as a key component of the national logistics network, Vietnam’s railway transport is still operating below its potential. Limitations in investment, infrastructure, intermodal connectivity and institutions are becoming major barriers, affecting the operational capacity and competitiveness of the entire industry.

One of the biggest barriers is that the investment capital for railways is too low , accounting for only about 3% - 4% of the total investment capital of the transport sector, while according to technical characteristics, the railway sector requires a very large initial investment and high synchronization. In addition, there is almost no significant participation from the private sector, most projects still depend on the state budget.

Due to the lack of a clear mechanism for risk sharing and benefit allocation, private investors are less interested in railway projects, which have a long payback period and lower financial returns than road or aviation infrastructure.

According to the report “Vietnam Logistics 2024”, railway transport currently only accounts for about 0.3% – 0.8% of the freight transport market share and 0.2% – 0.5% for passenger transport – a figure that has remained almost unchanged for many years.

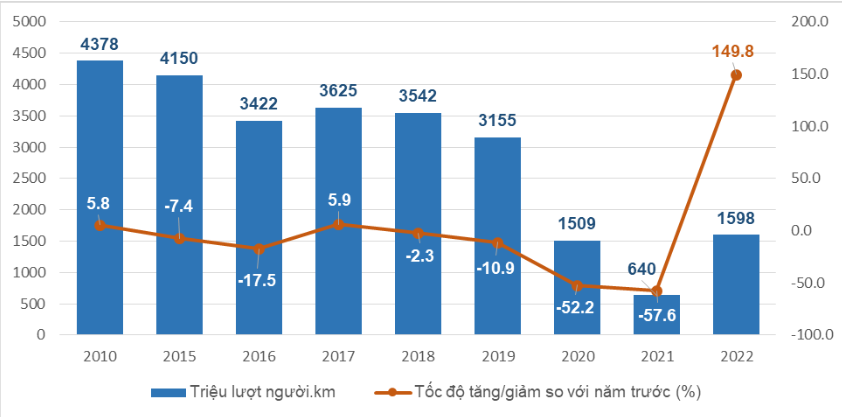

Railway passenger turnover in the period 2010-2022. Photo: General Statistics Office

These figures show that, despite efforts to improve, the railway sector is still struggling to expand its market share, both for passengers and freight. This reflects persistent shortcomings in infrastructure, investment and intermodal connectivity, while the potential of railways, with its low transport costs and capacity to transport large volumes, has not been fully exploited.

This figure not only reflects the weakness in operational capacity but also shows the level of “detachment from the market” of the railway industry – especially when compared with the explosive growth rate of other transport modes such as road and maritime.

The root cause is the lack of attractiveness in terms of time, price and flexibility, when the infrastructure is not modern, the connection is weak and the transit is cumbersome. This reduces the competitiveness of railways in modern supply chains - where speed and adaptability to customer needs are decisive factors.

The current railway infrastructure system is considered outdated in both technology and functionality. The North-South backbone still mainly operates a single 1,000mm gauge line, which is hundreds of years old, has limited transport capacity, and cannot meet the requirements of international standard container transportation.

The intersections between railways and roads are not yet completely separated, causing risks and affecting operating times.

In particular, railway connections to seaports, border gates, and industrial zones are still fragmented, lacking branch lines and feeder roads, disrupting the freight transport chain. To date, there are only 9 international transit stations nationwide, mainly concentrated in the North, including: Lao Cai, Yen Vien (Hanoi), Hai Phong, Dong Dang (Lang Son), Giap Bat (Hanoi), Da Nang, Song Than (Binh Duong) and 02 stations Kep (Bac Giang), Cao Xa (Hai Duong).

Map of the Lao Cai - Hanoi - Hai Phong - Quang Ninh railway route. Photo: National Planning

Meanwhile, the southern region, where a large volume of import and export goods is concentrated, lacks cargo consolidation centers directly connected to the railway.

Vietnam's logistics infrastructure is currently experiencing a shortage of specialized warehouses, limited loading and unloading infrastructure, and a lack of an integrated logistics network, making it difficult for logistics businesses to deploy full-package or multimodal services, forcing them to switch to other forms of transportation that are more flexible.

The shortage of high-quality human resources, from management, operations to engineering and maintenance, makes it difficult for the industry to meet the requirements of operational innovation and digital transformation.

In addition, the domestic railway support industry is still weak, and has not developed automation technology, locomotives, and spare parts according to international standards, leading to dependence on imports and high maintenance costs.

Although the Railway Law was issued in 2017, many institutional bottlenecks have yet to be resolved, especially the mechanism for managing and exploiting national railway infrastructure assets.

The separation between state management agencies and business operators is still unclear, reducing operational efficiency. Incentive policies and support for businesses investing in railway transport or transferring goods from road to rail have not really been put into practice.

The combination of the above factors not only causes the railway industry to gradually lose its role in the supply chain, but is also the reason why Vietnam's logistics costs continue to remain high (estimated at 16-17% of GDP).

Clearly identifying these “bottlenecks” is a premise for developing strategic solutions, thereby moving towards a modern, efficient and integrated railway system.

Strategic direction for railway logistics industry

To solve the problem of survival and restore the role of railways in the supply chain, the logistics industry needs a new approach – systematic and long-term.

In the period of 2023 - 2024, when the railway receives special attention from national leaders at all levels with the Resolution of the 13th National Party Congress and Conclusion No. 49-KL/TW of the Politburo, the railway industry is oriented to develop according to the goal of "modern and synchronous railway" - a key factor to promote rapid and sustainable socio-economic growth and meet the goal of transforming into a high-income developed country by 2045.

However, besides positive signs, the industry is facing many challenges that need to be thoroughly overcome to become a key pillar on the North-South transport corridor, the main East-West routes and in passenger transport in major cities.

According to the Vietnam Logistics 2024 report of the Ministry of Industry and Trade, in 2024, the railway sector will be assigned many key tasks such as amending and supplementing the 2017 Railway Law and completing 04 specialized technical plans. This shows the need to update management mechanisms, technical standards and investment norms in accordance with modernization requirements.

This will be the premise to ensure a solid legal framework, create conditions for synchronous railway infrastructure development, and reduce the "slow progress" in exploiting core railway routes such as Hanoi - Ho Chi Minh City and Hanoi - Lao Cai.

This shows a serious shortage of finance, especially when railways require large-scale and synchronous investment. The report also points out that investment capital for railways accounts for only 3% - 4% of total investment capital for the transport sector, while maintenance capital meets about 40% of the demand.

The railway industry is oriented to develop according to the goal of "modern, synchronous railway" to meet the goal of transforming into a high-income developed country by 2045. Illustration photo: CH

The policy of encouraging public-private partnership (PPP) is a feasible solution; in which, the state focuses on investing in important routes (for example, the approved investment policy for the North-South high-speed railway) while the private sector participates in building intermodal freight stations and supporting infrastructure, enhancing connections to seaports and border gates.

The market share of railway transport is still very low, which can be attributed mainly to the lack of connection to seaports and border gates. The highlight of the 2023-2024 period is the Ministry of Transport's recognition of Kep station as an international transit station, contributing to increasing transport output in Bac Giang and the northern provinces, while reducing the load on Huu Nghi and Yen Vien stations.

With the recognition of Cao Xa station (Hai Duong), which has a favorable location connecting large industrial parks, the total number of international transit stations has increased to 09, which will help improve the connectivity of railway infrastructure, expand logistics services and take advantage of transporting traditional goods such as ore, apatite, gasoline and oil as well as serving international transit routes to China and Europe.

The report also noted the renovation and upgrading of some key points on the Hanoi – Ho Chi Minh City and Hanoi – Lao Cai routes, along with the construction progress of the 5.67km section of the Yen Vien – Ha Long – Cai Lan route.

Although there are still about 35.33km of the planned 41km route still unfinished, this is a necessary initial step to create a stable, modern and scalable railway transport structure to meet the needs of large-volume transport in the future.

Digital transformation will become a successful direction in the railway industry in the near future. The renovation of key points must be accompanied by investment in equipping automation systems at stations, container yards and operation centers.

Automated technology will help optimize loading and unloading, reduce transit time and increase operational safety. As a result, the railway will not only be competitive in terms of cost but also ensure service quality according to international standards.

To effectively exploit investment and technology solutions, the railway industry needs high-quality human resources. Adjusting training programs, combining with industry practices and cooperation between businesses, universities and research institutes will help build a team of experts in the fields of transport, logistics and digital technology.

In addition, the modernization of the railway industry cannot lack the synchronous development of supporting industries: from the production of carriages, loading and unloading equipment, to automation systems and management software.

A strong domestic supply chain will help reduce dependence on imports and increase the industry's competitiveness in the international market.

If synchronous solutions from planning improvement, digital technology application, human resource development and legal framework improvement are thoroughly implemented, the railway industry will not only improve transport efficiency, but also become the main driving force supporting sustainable economic development, contributing to realizing the vision of becoming a "high-income developed country" by 2045.

Challenges in investment, infrastructure connectivity and resource shortages, although difficult to solve, if overcome synchronously through solutions to increase investment, improve the legal framework, apply digital technology and coordinate multimodality, the railway system promises to become the key to opening a sustainable development future for Vietnam's logistics industry.

Railway transport enterprises need to work together with authorities to seize opportunities for change, thereby affirming their position in today's fiercely competitive market.